Credit Benchmark have released the April Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The April CCIs have seen credit deterioration across the board for UK, EU and US industrial companies.

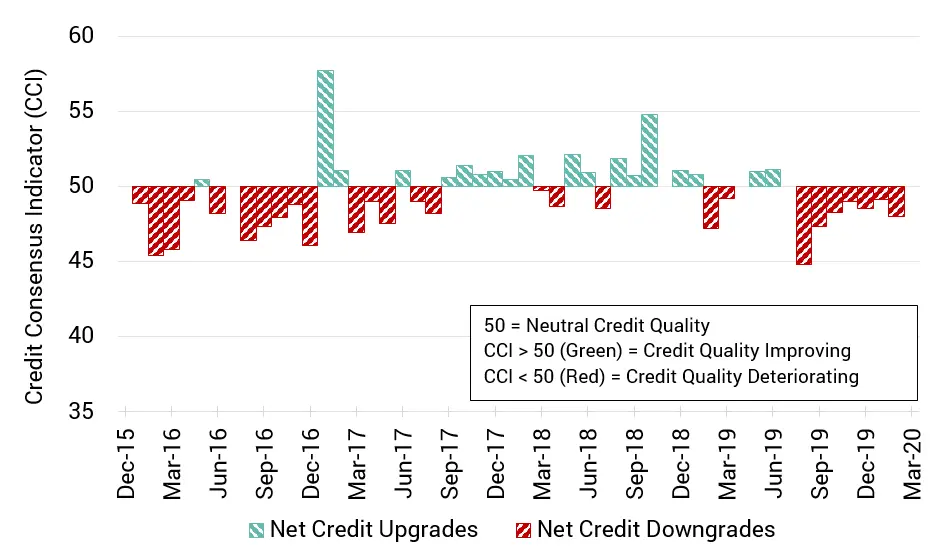

The UK Industrials CCI for April is 49.4; return to credit deterioration

The credit risk of UK Industrial companies has been dominated by downgrades in the past month.

The CCI for this month sits at 49.4; a return to negative territory after minor respite at the start of the year.

Efforts to switch manufacturing output to much-needed ventilator and PPE supplies has been compared positively to past wartime collaboration, but the sector faces an uphill fight against supply chain disruption and a sudden and severe contraction in demand.

.

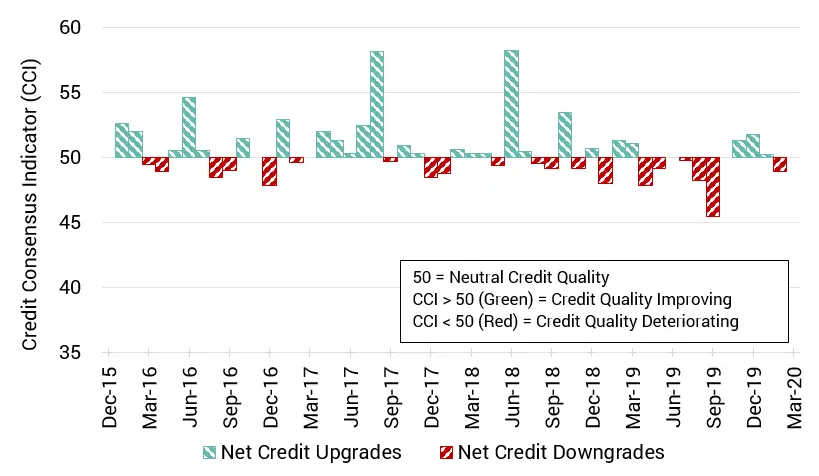

The EU Industrials CCI for April is 48.9; back in negative territory

After several months of net credit upgrades, EU Industrials have fallen back into negative territory.

This month, the CCI for the region’s industrial companies is 48.9.

Given Germany’s industrial dominance and relative minimisation of coronavirus impact, the group may yet fare better than their US and UK counterparts – though the hit to Italian and French manufacturing threatens to drag down the average.

.

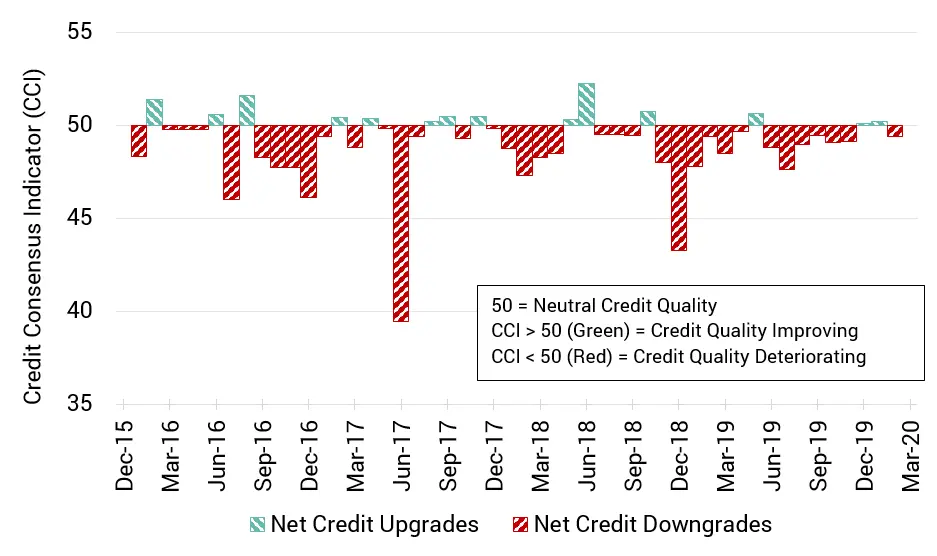

The US Industrials CCI for April is 47.9; seventh consecutive month of net downgrades

US Industrial companies have seen a seventh consecutive month of net credit downgrades.

The CCI for US firms sits at 47.9 this month; the longest continuous run in either direction for the tracked time period.

The Federal Reserve recently reported a drop of 6.3% in US manufacturing output; the biggest decline since WW2. This is largely due to the closure of several large auto factories.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: