The financial world relies on countless risk decisions.

Make them faster and more confidently with Credit Benchmark.

Introducing CRI:

Credit Risk Index

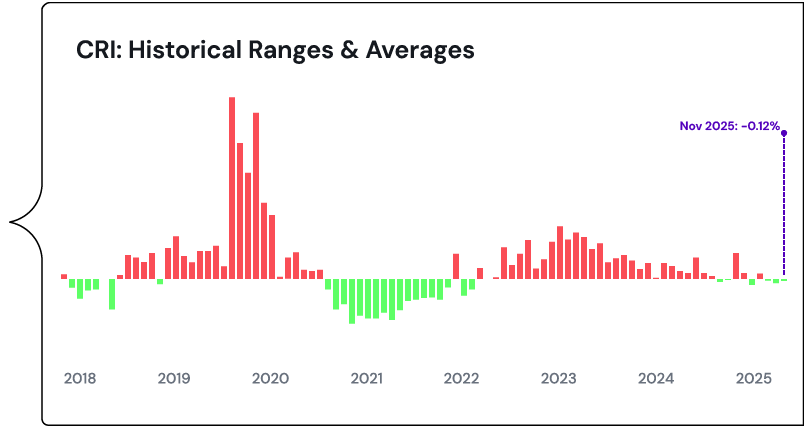

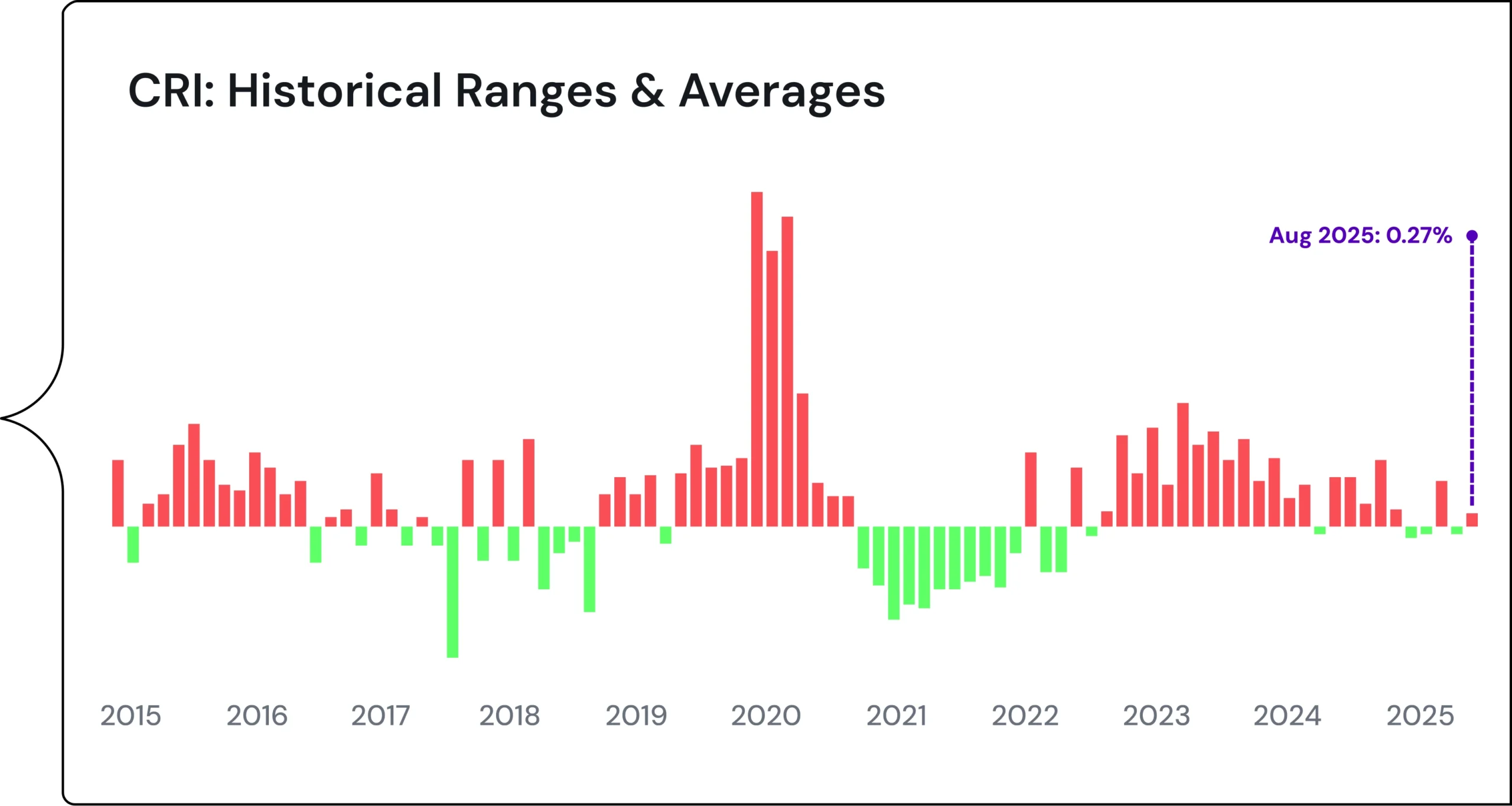

10 years of contributor insight reveal default rate shifts for US Private Corporates.

Introducing CRI:

Credit Risk Index

10 years of contributor insight reveal default rate shifts for US Private Corporates.

KNOW RISK.

KNOW CREDIT

BENCHMARK.

WHY CREDIT BENCHMARK?

Built by and for risk professionals, we offer a robust, independent alternative to traditional ratings models.

See what others

can’t see

Access the world’s largest and most timely

consensus risk dataset—covering 120,000

public and private entities, most of them

unrated—to gain visibility others can’t. Uncover

hidden risks and opportunities with a uniquely

comprehensive view across markets, sectors,

and geographies.

Access the wisdom

of the crowd

By leveraging the views of risk professionals

from over 40 of the world’s largest financial

institutions on their own exposures, you gauge

real-world market sentiment as independently

validated intelligence. Uniquely derived from

those with ‘skin in the game’, you gain the

consolidated perspective from those who

need to know.

Track an ever-evolving

picture

Multiple contributions per entity provide dynamic insights into how risk is shifting over time. From “the street” to your inbox, our timely intelligence empowers real-time responsive risk management. Early warning signals let you act before others and make decisions with confidence.

Stay in The Know

With oversight from financial regulators, you can ensure the contributions from financial institutions are validated and updated on a regular basis, and a contributor’s risk processes remain resilient in the face of a volatile economic landscape.

WHAT WE OFFER

Built by and for risk professionals across banking and finance

globally, our data-driven solutions put you in The Know and ready to respond.

We support a variety of risk management and capital allocation use cases.

Our Solutions

CREDIT CONSENSUS AT A GLANCE

Unparalled Coverage

90%+ of the entities with Credit Consensus Ratings are unrated by the large credit rating agencies.

Up-to-Date, in The Know

Multiple updates every month provide timely insights into potential credit risk changes, enabling you to stay ahead with dynamic indicators of the changing landscape.

Real-World Perspectives

Access proprietary modeled outputs based on the views of risk takers for risk takers, ensuring a complete picture of risk, differentiated from traditional ratings.

Robust Methodology

Our Consensus requires multiple observations per entity before publishing to ensure the quality of the information presented.

Range of analytics

Leverage over 100 data items at the entity and industry-level to understand how risk is shifting at a micro and macro level.

Safety in numbers

Millions of data points collected across 160 countries and all major sectors.

STAY IN THE KNOW

Research & Insights

Credit Risk Priorities and Trends for 2026: What Client Conversations Reveal

Across hundreds of conversations with banks, insurers, asset managers, and other non-bank financial institutions, one theme dominates: credit risk management is under sustained pressure.

7 Credit Risk Management Best Practices For Commercial Banks Using Consensus Data

Corporate default rates are expected to remain elevated through 2026, according to S&P Global. For

7 Best Credit Risk Analysis Software and Solutions for Commercial Banks: Category Comparison Guide for CCOs

You manage a commercial portfolio where the majority of counterparties lack external credit ratings. Your

Webinar: 2025 Product Highlights and 2026 Roadmap Preview

Recapping the major updates from 2025 and previewing the 2026 roadmap, focusing on how these

Building Default Probability Term Structures From Credit Consensus Data

Build multi-year PD term structures from Credit Consensus Ratings using transition matrices for CVA, pricing,

Testimonials

What our customers and partners say

"Credit Benchmark enables us to say yes faster and potentially get bigger deals approved. With an independent benchmark validating our internal ratings, we make quicker, more confident decisions at all levels."

"We gain the perspective of multiple analysts in one consensus rating. Credit Benchmark expands our visibility into private and unrated names, improving our models and risk insight."

“Credit Benchmark gives us the confidence to expand our risk appetite, approve larger underwriting deals, and raise ratings where justified — helping us win more business and grow faster, without compromising risk standards.”

"Credit Benchmark strengthens our counterparty risk management and internal reporting. External validation increases regulatory confidence and trust in our credit models."

“Credit Benchmark provides the early warning signals we need to stay ahead of emerging risks. It sharpens our focus, highlights exposures that need action, and enables more proactive portfolio management — strengthening our overall risk oversight.”

"Credit Benchmark lets us monitor more counterparties with greater confidence and no extra headcount – allowing us to streamline credit assessments and focus our resources."