Corporate default rates are expected to remain elevated through 2026, according to S&P Global. For banks managing commercial lending portfolios, this environment requires balancing loan growth targets against capital preservation and regulatory capital requirements.

Most banks face three structural constraints despite sophisticated internal models:

- Annual review cycles systematically miss deterioration that consensus contributors detect 6-8 months earlier through continuous exposure management.

- Basel 3.1 increases pressure for comparability and defensible validation evidence; independent external benchmarks are especially valuable where public market signals are limited.

- In CCAR/ICAAP contexts, supervisors expect strong model risk management (independent validation, effective challenge, and documentation). External benchmarks are often a highly defensible validation input, especially where available.

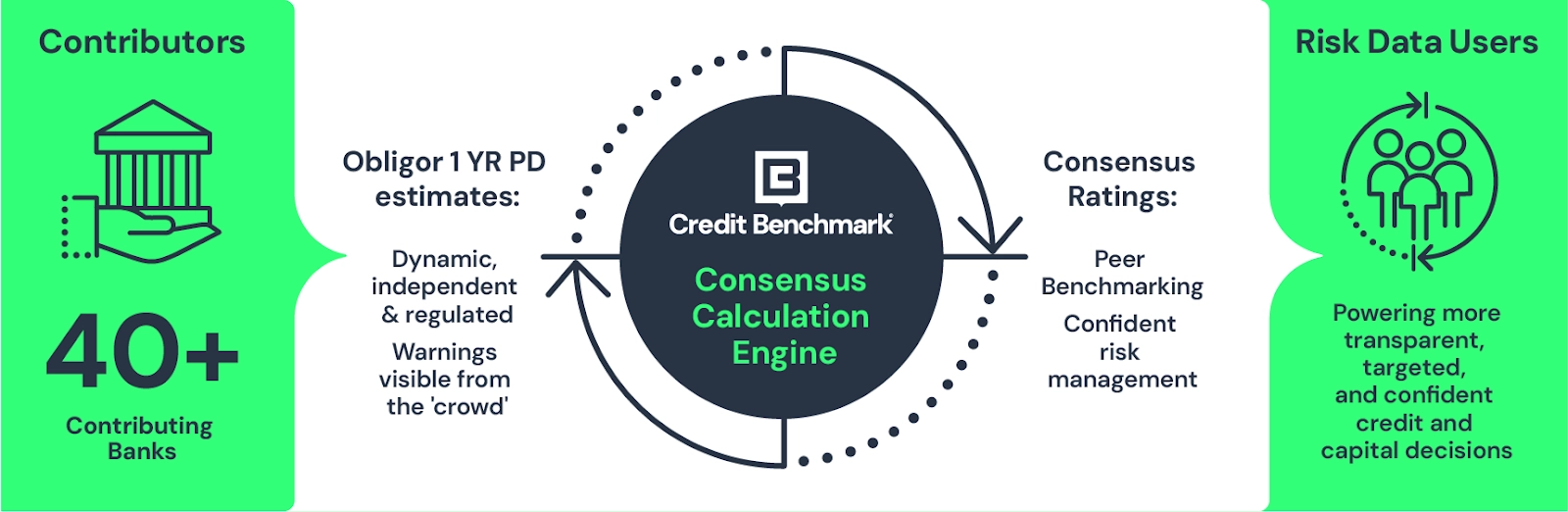

Consensus credit data resolves these constraints by pooling credit opinions from over 40 global banks that maintain direct lending relationships with borrowers. This aggregated view strengthens independent challenge and benchmarking for prudential model risk management under Basel III frameworks, while providing external credit signals that support reasonable and supportable assumptions in IFRS 9/CECL estimation governance. Weekly updates enable continuous credit surveillance between formal review periods.

If you’re validating credit models, monitoring portfolio risk, or defending credit decisions to stakeholders, the seven practices below demonstrate how to reduce defaults and optimize capital allocation with consensus data, without relying on lagging indicators that reveal problems only after they become irreversible.

1. Validate Internal Models Against Independent Market Views

Banks need objective frameworks to challenge credit analyst assessments. When internal ratings deviate from consensus views, institutions often lack clear protocols to determine when external market signals should trigger model recalibration versus representing legitimate analytical differences.

Consensus data aggregates credit views from 40+ banks with actual lending exposure to the same borrowers. These regulatory-grade credit assessments provide independent validation free from issuer-pays conflicts. When multiple banks converge on a view that differs from your internal rating, the deviation signals potential model miscalibration rather than routine analytical disagreement.

Regulators and auditors increasingly expect robust model governance—independent validation, effective challenge, and clear documentation—often supported by credible external reference points where available. Setting override triggers is a governance best practice, not a regulatory requirement.

A documented override policy with monitoring and escalation supports model risk management expectations and helps evidence disciplined decision-making.

2. Integrate Consensus Data Into Portfolio Coverage Workflows

Coverage reports to credit committees classify 70-80% of commercial portfolios as “unrated exposure” despite consensus ratings existing for these borrowers. Credit officers track coverage gaps in spreadsheets while 120,000+ entities with consensus validation remain categorized as requiring manual assessment.

Consensus ratings provide external validation for private companies, subsidiaries, and middle-market borrowers that lack public ratings. Contributing banks assess these entities through direct lending relationships, creating a parallel rating universe that extends beyond traditional agency coverage.

Redefine portfolio classification systems to reflect total external validation:

- Coverage metrics: Report combined agency and consensus coverage, not agency coverage alone.

- Gap prioritization: Focus resources on entities lacking both agency and consensus ratings—true blind spots versus unused available data.

- Private market benchmark: Establish consensus as the primary external reference for fund exposures and private borrowers, rather than treating the absence of agency ratings as a validation gap.

For Fund Financing and Significant Risk Transfers (SRTs), apply consensus data to underlying portfolio companies. This reveals whether fund holdings represent concentrated or diversified credit risk—critical for accurate exposure assessment.

3. Automate Surveillance to Enable Continuous Monitoring

Banks receive weekly consensus data feeds but continue operating annual review cycles. By the time analysts manually process updated ratings and schedule reviews, deteriorating credits have migrated multiple notches.

Consensus ratings update based on millions of borrower observations across the contributor network, capturing credit momentum that often precedes traditional agency actions by quarters. Weekly or bi-monthly feeds capture this credit momentum before deterioration becomes irreversible.

Configure automated surveillance systems that convert consensus data from static reports to dynamic alerts:

- Rating movement alerts: Flag any one-notch downgrade or dispersion widening above 2 notches.

- Escalation protocols: Multi-notch downgrades within 90 days trigger immediate credit committee review regardless of internal rating schedule.

- Resource reallocation: Shift analysts from routine monitoring of stable credits to investigating flagged exceptions.

This ensures your bank responds to market-detected stress rather than discovering deterioration independently months later through scheduled reviews that consensus contributors already acted upon.

4. Apply Transition Matrices to Stress Testing and Capital Planning

Capital planning applies uniform default rate shocks across portfolios rather than modeling realistic cohort migration under stress. Consensus data provides forward-looking migration probabilities, yet stress tests remain anchored to static ratings without projecting realistic through-the-cycle movements that transition data reveals.

Credit rating transition matrices derived from consensus data show empirical migration patterns—such as the probability that a ‘bb’ rated entity downgrades to ‘b’ or defaults within twelve months under various economic conditions. These patterns provide statistically grounded inputs for projecting portfolio credit quality under stress scenarios rather than theoretical assumptions.

Incorporate consensus-derived probabilities into regulatory stress testing:

- Migration modeling: Apply consensus-derived transition matrices to project how rating cohorts migrate under adverse scenarios. For example, model how ‘bbb’ and ‘bb’ exposures migrate to ‘b’ and ‘ccc’ categories during downturns based on historical transition patterns, then calculate resulting default rates for capital planning.

- Correlation analysis: Use credit risk correlation matrices to identify sectors and geographies where credits move together during stress, revealing concentration risks that standard exposure reports miss.

- Capital optimization: Refine probability of default calibrations to improve accuracy, stability, and defensibility of Risk-Weighted Assets and stress outcomes, aligned with Basel 3.1 comparability expectations.

5. Extend Counterparty Risk Assessment Beyond Direct Exposures

Credit Valuation Adjustment (CVA) desks face proxy curve construction challenges when CDS spreads are unavailable for unrated counterparties—the standard fallback under Basel frameworks. Prime brokerage and clearing operations assess direct counterparty creditworthiness but lack visibility into the credit quality of their clients’ underlying exposures, creating unmonitored second-order risks within counterparty networks.

Counterparty credit risk extends beyond bilateral exposure to network effects where a single entity’s default cascades across clearing arrangements and derivative portfolios. Consensus data covers both direct counterparties and their clients, providing credit assessments for entities within clearing member networks and enabling institutions to evaluate concentration risk at multiple levels of their counterparty hierarchy.

Apply consensus ratings across your entire counterparty network structure:

For CVA Calculations:

Where CDS spreads are unavailable, Basel frameworks require proxy spread methodologies based on rating, region, and industry. Consensus PDs inform proxy curve construction by providing empirical credit signals that calibrate spread assumptions within your approved CVA model framework.

This approach ensures derivative valuations reflect market-informed credit risk rather than purely mechanical proxy assignments, subject to your recovery rate assumptions and curve methodology.

For Clearing and Prime Brokerage:

- Map consensus ratings across clearing member client bases to identify weak links before they create systemic exposure.

- Establish monitoring protocols where deteriorating consensus ratings for clearing member clients trigger exposure reviews and potential margin adjustments.

- Assess not just direct counterparty soundness, but whether client concentrations pose cascading risk during market disruption.

6. Resolve Entity Mapping Bottlenecks That Delay Implementation

Reconciling internal identifiers with consensus data entities takes weeks or months, during which the credit ratings and migration insights remain entirely inaccessible. Credit systems use inconsistent entity names, lack Legal Entity Identifiers, and track exposures at different consolidation levels—all preventing banks from extracting analytical value until matching is complete.

Automated entity resolution engines normalize naming conventions and map complex corporate hierarchies systematically because they process millions of entity variations across contributing institutions.

For example, Credit Benchmark’s engine resolves like “IBM Corp,” “International Business Machines,” and “IBM” as the same entity while mapping parent-subsidiary relationships that determine appropriate consolidation levels.

Leverage vendor-provided mapping infrastructure rather than building internal reconciliation:

- Initial submission: Provide portfolio files containing whatever identifiers your systems currently maintain (LEIs, entity names, internal codes).

- Automated matching: Allow mapping engines to handle initial reconciliation while analysts focus on reviewing suggested matches and resolving true ambiguities.

- Master crosswalk: Establish entity identifier mapping once, then maintain incrementally as new counterparties enter your portfolio.

- Consolidation decisions: Focus analyst effort on determining appropriate consolidation levels (subsidiary versus parent exposure) rather than name-by-name matching.

This front-loaded investment enables ongoing consensus data utilization without repeated reconciliation cycles, allowing credit teams to access validation insights within weeks rather than quarters.

7. Prepare for Regulatory Examinations and Strengthen Risk Reporting

Banks face heightened regulatory scrutiny of credit risk model validation and governance. Supervisors expect systematic validation frameworks with independent, data-driven evidence supporting internal credit decisions. Inadequate documentation and weak use of external benchmarks invite supervisory criticism and examination findings.

Consensus data provides the independent, market-based validation that regulators require during examinations. Aggregated views from 40+ banks demonstrate that internal ratings align with or deviate from broader market assessment in systematic, defensible ways.

Structure regulatory examination preparedness around three validation components:

- SNC Examination Documentation

- Maintain consensus ratings for all shared national credits above examination thresholds.

- Document specific instances where internal grades differ from consensus by two or more notches, with written justification for material deviations.

- Demonstrate that credit grade changes align with broader market deterioration or improvement patterns rather than isolated judgment.

- Basel III/IV Model Validation

- Provide independent benchmarking evidence that PD calibrations align with consensus-derived probabilities across rating categories.

- Document systematic validation processes that compare internal model outputs against market consensus quarterly.

- Show statistical analysis of rating deviations by industry, geography, and borrower size to identify and address model bias.

- Board and ALCO Reporting

Present three executive-level metrics that translate technical validation into strategic insights:

- Coverage percentage: Portion of credit exposure with external validation versus true blind spots, demonstrating validation infrastructure strength.

- Systematic deviation patterns: Whether the bank rates specific sectors or geographies more conservatively or aggressively than market consensus, enabling risk appetite discussions.

- Early warning effectiveness: Percentage of borrowers where consensus ratings detected deterioration before internal reviews, measuring surveillance system performance.

Maintain audit trails linking consensus ratings to specific credit decisions with timestamped records showing when consensus data was reviewed, what deviations were identified, and what actions resulted. This creates regulatory-ready documentation demonstrating systematic validation processes rather than ad hoc consensus data usage.

3-Step Diagnostic Framework: Identify Your Implementation Priorities

Before scaling consensus data usage, conduct a one-time health check that quantifies three critical implementation barriers: entity matching friction, coverage blindspots, and rating deviation patterns. This diagnostic reveals which best practices require immediate attention versus longer-term process changes.

Step 1: Quantify Entity Mapping Efficiency

Submit a representative portfolio file containing standard internal identifiers—whatever format your credit systems currently maintain. Review automated mapping results to determine what proportion matches cleanly versus requires manual review.

High match rates indicate readiness to proceed directly to deviation analysis, while low match rates signal you should prioritize Best Practice 6 (entity resolution) before expanding consensus data usage. Examine unmapped entities to determine whether gaps result from naming inconsistencies you can standardize or entities outside consensus coverage.

Step 2: Measure Portfolio Coverage Gaps

Analyze the matched portfolio subset to determine what portion of your exposures (by count and by balance) has consensus ratings available. Segment coverage by sector, geography, and entity type to identify where blind spots concentrate.

Substantial unrated exposure where consensus coverage is available should trigger Best Practice 2 (coverage workflow integration) to redefine what constitutes a true data gap versus unused available data.

Large concentrations lacking both agency and consensus ratings must determine whether to expand consensus coverage, accept limited validation, or reduce exposure to truly unvalidated borrowers.

Step 3: Identify Systemic Rating Biases

For the matched and rated subset, map your internal rating scale to consensus ratings and examine the distribution of notch differences. Calculate average deviation by sector and rating category to reveal systematic biases in your internal models.

Conservative deviations (rating riskier than consensus) should be documented as deliberate risk appetite decisions reflecting your bank’s lending standards. Aggressive deviations (rating safer than consensus) require immediate model recalibration under Best Practice 1, as these borrowers may carry more risk than your capital allocation assumes.

High deviation combined with strong consensus agreement (low dispersion) represents your highest priority validation queue. High deviation with weak consensus agreement indicates multiple defensible views where deviation may reflect legitimate analytical differences rather than model error.

Implementation Case Study: How a Top U.S. Bank Strengthened Credit Risk Management with Consensus Data

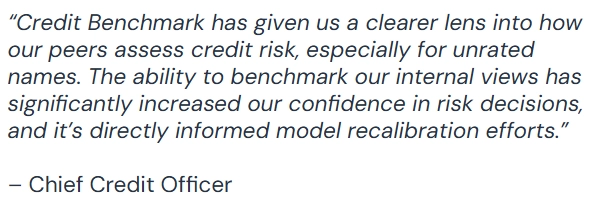

A major U.S. bank with approximately $150 billion in assets needed peer-driven insights to pressure-test internal credit models and validate risk assessments for borrowers lacking traditional ratings.

The Chief Credit Officer recognized that without external benchmarks, the bank couldn’t determine whether its credit views were too conservative, too aggressive, or appropriately calibrated relative to market consensus.

The bank embedded Credit Benchmark’s consensus data directly into credit model workflows, using peer insights to recalibrate probability of default (PD) and loss given default (LGD) parameters. The solution provided market validation for SNC examination preparation and enabled systematic model refinement based on aggregated views from peer banks with lending exposure to the same borrowers.

Key Outcomes:

- Improved model accuracy by pressure-testing against market consensus and strengthening alignment with peer bank views.

- Stronger regulatory positioning through peer validation evidence used in SNC examination preparation.

- Confident credit decisions on unrated borrowers where traditional validation methods weren’t available.

- Enhanced benchmarking discipline by validating internal assessments against anonymized peer views.

Achieve Confident Credit Decisions with Consensus Data Validation

Traditional credit risk management creates structural gaps that consensus data directly addresses. Annual review cycles miss deterioration that continuous monitoring detects. Rating agencies leave significant commercial portfolio segments unvalidated—Credit Benchmark covers 120,000+ entities, 90% lacking traditional agency ratings. Internal models operate without independent benchmarks until consensus views provide market-tested validation.

Banks that embed these seven practices transform consensus data from purchased reports into operational validation infrastructure. The diagnostic framework quantifies implementation priorities—coverage gaps requiring immediate attention versus longer-term workflow changes.

Credit Benchmark provides portfolio analysis showing current coverage, entity mapping efficiency, and systematic rating deviations across your commercial book

Schedule a demo to review your portfolio against consensus views