The U.S. private credit landscape is shifting. After tentative improvement earlier this year, bank sentiment toward the creditworthiness of U.S. borrowers worsened through Q3 2025, according to Credit Benchmark’s newly launched Credit Risk Index (CRI).

Backing the CRI are the internal risk ratings of over 40 leading global banks. As part of a data sharing model, Credit Benchmark receives over 1 million risk ratings per month on over 450,000 unique entities from contributing banks.

The CRI focuses on bank sentiment for a selected universe of around 3,000 U.S. companies. Because of both the data’s provenance and the selected entities, the CRI provides a real-time view of credit sentiment in private markets – areas that are often opaque to investors and policymakers.

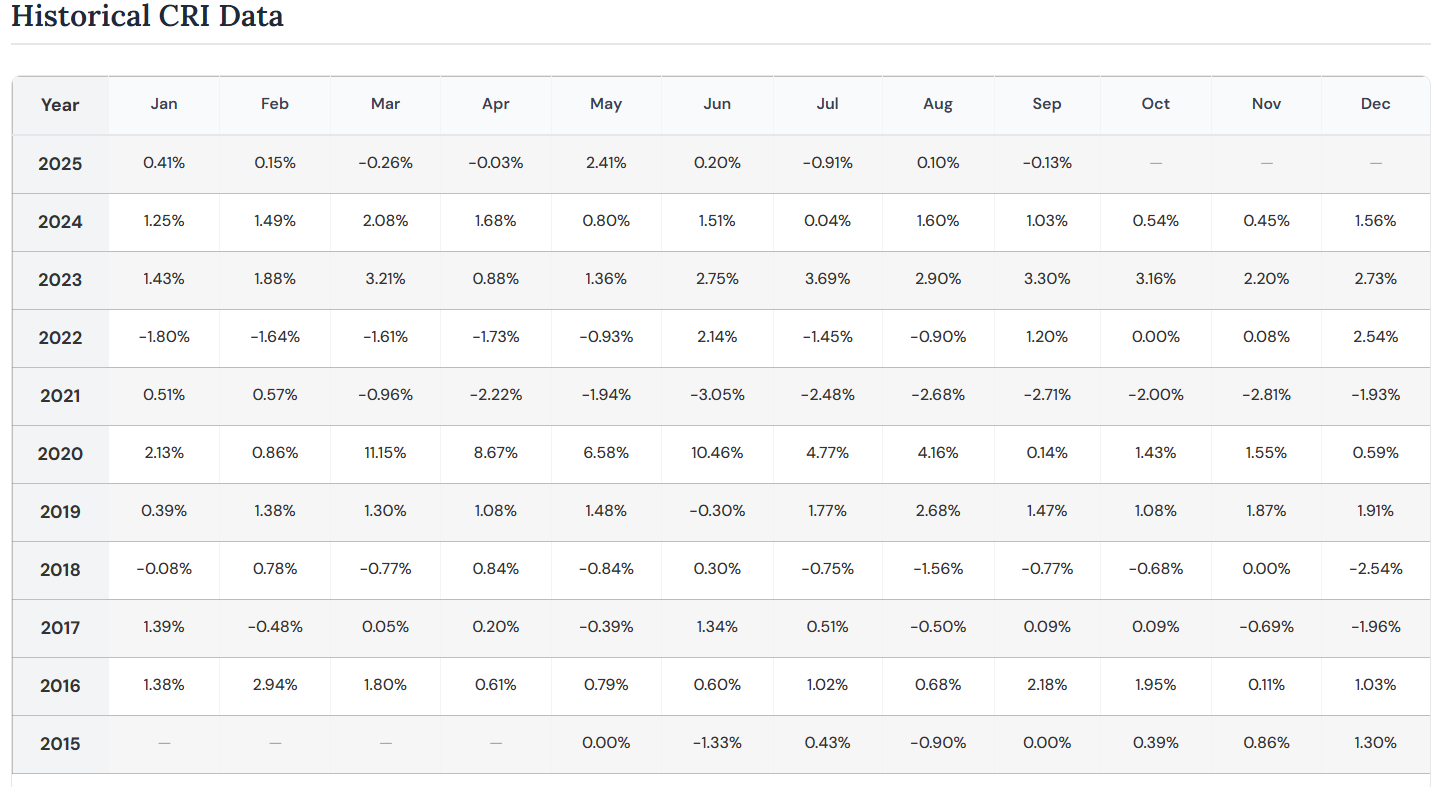

The CRI is defined using net rating changes on the 100-point scale i.e. very granular and fine-tuned to emerging changes: downgrades minus upgrades for U.S. private corporates and financials.

- A positive CRI indicates net downgrades (rising credit risk)

- A negative CRI indicates net upgrades (improving credit quality)

The data show that:

- The CRI improved -0.1% in September, after a modest deterioration of 0.1% in August[1], marking a relatively neutral period.

- Overall, the prior 36 periods saw 31 months where downgrades outweighed upgrades.

- In September specifically, Telecoms, Autos & Parts and Travel stand out as sectors with heightened credit deterioration, while Basic Resources, Media and Household Goods show resilience.

This white paper explores the findings behind the CRI’s latest results, industry-specific credit sentiment trends, and what they reveal about the state of the U.S. economy heading into 2026.

1. Introduction: A New Lens on Private Credit Risk

Traditional credit metrics – public bond ratings, CDS spreads, or macroeconomic indicators – tell only part of the story. A substantial portion of U.S. corporate borrowing occurs off-market, in the form of private bank loans that do not appear in secondary markets.

Until now, systemic visibility into this space was limited. Credit Benchmark fills that gap by aggregating the anonymized internal credit assessments of more than 40 global banks, representing the judgments of 20,000 analysts on $9 trillion in loans across 160 countries.

Within this universe, the CRI focuses on U.S. credit. The CRI distills thousands of independent lender assessments into a single composite measure of net credit sentiment – a gauge of whether banks are tightening or loosening their internal ratings across sectors.

“The CRI addresses a blind spot in understanding credit risk trends in private markets,” said Michael Crumpler, CEO of Credit Benchmark. “It gives risk professionals an objective, data-driven way to monitor early credit deterioration – before it’s reflected in bond markets or default rates.”

2. The State of Credit Sentiment: 2022–2025

The CRI reveals a clear pattern: after years of gradual tightening, banks have turned more cautious again in 2025.

Key Metrics

- Net deterioration: 465 industry aggregate downgrades vs. 259 upgrades since 2022 (nearly 2X).

- Cumulative CRI increase: +48% over three years.

- Monthly direction: Net downgrades recorded in 31 of the past 36 months.

This prolonged stretch of downgrades reflects persistent concern over leverage, margin compression, and refinancing risk as higher interest rates continue to work through corporate balance sheets.

Year-to-date 2025, the flagship CRI has deteriorated by 1.9%. Between February and April, modest improvement hinted at stabilization, but that momentum reversed over the summer. The sharpest decline came in May, with a 2.4% net downgrade. Overall, the index has trended weaker, with August marking a renewed wave of downgrades that pushed it to its highest level in nearly a year.

3. CRI historically has correlated with S&P Default Rates

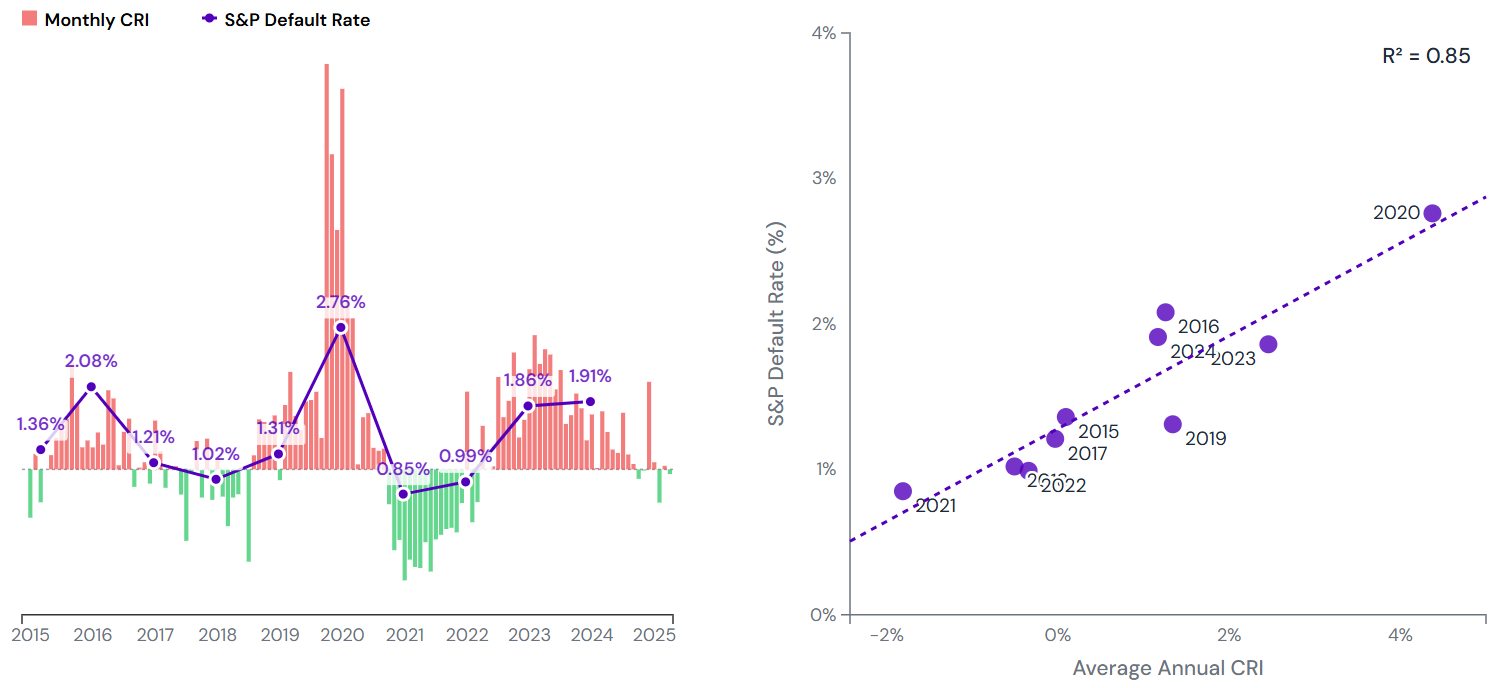

As a preliminary test to understand the usefulness of the CRI, we measured the annual CRIs against the published S&P observed Default Rates. The time series chart on the left illustrates how the S&P default rate (in purple) often follows the movements in the monthly CRI.

The scatter plot on the right makes this relationship even clearer, showing a strong positive correlation between the two metrics with an R² = 0.85. This suggests that the CRI is not only a concurrent indicator but a powerful predictor of broader corporate defaults.

Source: S&P Global Ratings

Key Findings:

- We calculate the average CRI for each calendar year to match S&P’s annual default rate reporting.

- The strong correlation (R² =0.85) suggests the CRI is a reliable leading indicator for corporate defaults.

The strong fit suggests that the Credit Risk Index is a real-time indicator of the credit environment. While it shows a strong fit at a macro, US Corporates, level we can dive deeper into specific sectors within the CRI to uncover industry trends.

4. Where the “Cockroaches” Are: Industry-Level Stress

Autos & Parts: Ground Zero for Credit Deterioration

The CRI’s auto sector sub-index has surged 6.7% in September and 45% over the last 12 months, making it one of the most stressed industries tracked.

The recent bankruptcy of First Brands Group highlights structural fragility among smaller suppliers. Downgrades in the sector have consistently outpaced upgrades for months, reflecting shrinking margins and delayed demand recovery.

As Jamie Dimon noted, “When you see one cockroach, there are usually more.” (Reuters, 10/14/25) The auto industry’s string of downgrades may be the first visible warning of broader weakness across consumer-linked manufacturing.

Travel, Leisure, and Media: Fragile Consumer Exposure

Discretionary sectors such as travel & leisure and media have also seen net downgrades. The travel & leisure sub-index climbed 2.8% in September and 23% year-on-year, consistent with weakening consumer affordability and uneven demand recovery post-pandemic.

Telecoms

The telecommunications sector saw the greatest deterioration in September at 7.9%, 18% year over year and 55% over the last 2 years. Potential drivers may include heavy capital expenditure and high debt burdens, slower growth, and regulatory pressure.

5. Bright Spots in an Uneven Landscape

While several real-economy sectors are flashing red, financial industries tell a different story.

Credit Benchmark data shows improving sentiment in Insurance, Real Estate, Basic Resources and Financial Services, with net upgrades exceeding downgrades in these categories.

Balance sheet strength, capital buffers, and improved interest income have supported stability in these sectors — suggesting that credit stress remains selective rather than systemic.

6. The Value of Aggregated Bank Sentiment

Credit Benchmark’s methodology is straightforward but powerful:

BANK SUBMISSION

- Over 40 leading global banks contribute internal ratings monthly through Credit Benchmark’s Consensus Credit Rating (CCR) service.

- A contributor bank may change its internal rating on an entity based on their credit assessment.

ENTITY LEVEL

- For each entity, Credit Benchmark tracks the net direction of rating changes across all contributing banks on a granular 100-point scale.

- If net contributor movements are upgrades, the entity is counted as an upgrade; if net movements are downgrades, the entity is counted as a downgrade.

CRI UNIVERSE

- All entity-level upgrades and downgrades across the ~3,000 entity universe are aggregated into the monthly CRI percentage.

This creates a consistent and transparent indicator of how banks perceive credit quality in real time, offering several advantages over market-based measures:

- Early detection: Bank internal ratings often change before public defaults or rating agency actions.

- Private coverage: Many obligors in the CRI have no public ratings or traded debt.

- Sector granularity: Enables detection of industry-specific shifts that precede macro signals.

In essence, the CRI translates lender behavior into market intelligence — a forward-looking proxy for credit risk that complements conventional analytics.

7. Implications for Risk Managers and Policymakers

The implications of the CRI extend beyond the banking system.

- For lenders: It offers peer-based benchmarking, helping banks calibrate internal credit models and adjust exposure early.

- For investors: It identifies hidden deterioration in private credit portfolios before it surfaces in valuations.

- For regulators: It enhances macroprudential surveillance of the non-public corporate debt market, an area growing in size and systemic importance.

Monitoring the CRI alongside bond spreads, default rates, and rating-agency data provides a multi-dimensional picture of credit health — enabling proactive risk management rather than reactive loss mitigation.

8. Conclusion: Seeing the Roaches Early

The metaphor of “finding the cockroaches” captures the essence of credit surveillance. Problems rarely occur in isolation. When downgrades cluster — as they are in autos, health care, and media — they often point to broader vulnerabilities ahead.

Credit Benchmark’s CRI offers an early warning system for those willing to look where others can’t: inside the aggregated, confidential judgments of the global banking system.

“By capturing how banks are internally re-evaluating their loan books,” said Crumpler, “the CRI reveals turning points in credit quality before they appear in public markets.”

As 2026 approaches, vigilance will be key. The CRI’s continuing publication — updated monthly — provides a reliable signal of shifting credit sentiment across the private U.S. economy.

About Credit Benchmark

Credit Benchmark is the world’s leading provider of consensus credit risk data, derived from the internal credit assessments of over 40 global banks. Its database spans 120,000 obligors, covering $9 trillion in loans across 160 countries, including corporates, financial institutions, funds, and sovereigns. By pooling this collective intelligence, Credit Benchmark delivers unique insight into credit risk trends in both public and private markets.

For more information, contact:

- Michael Crumpler, CEO – [email protected]

- Christa Ancri, Global Head of Marketing – [email protected]

- Ryan Hoffman, Analytics Manager – [email protected]

Appendix

[1] The August CRI was restated from its original publish of 0.27 to 0.10 due to additional bank data contribution and data cleanup. This type of movement is normal and within a reasonable range.