Do the world’s largest banks move their internal credit ratings quicker as new events unfold, or are smaller regional bank more nimble with their credit assessments?

This article analyzes how swiftly banks update their internal credit views, breaking down trends by region and Global Systemically Important Bank (GSIB) designation. We explore whether region and systemic importance drive faster reactions to shifting credit conditions.

For credit risk teams, the findings offer a data-backed lens into peer behavior.

Credit Risk Across 10 Years

Credit Benchmark’s extensive database of banks’ internal credit ratings spans 10 years and includes data from approximately 40 banks. This period incorporates the Covid downturn & recovery, Russia’s Invasion of Ukraine and recent turmoil from Trump’s policies.

During this time, banks’ credit risk teams & internal rating models have had to react to an increasingly volatile world. But not every bank is equal.

In this article we look at whether size does equal speed. Credit Benchmark’s dataset includes data from 16 GSIBs, which we use as an indicator of size.

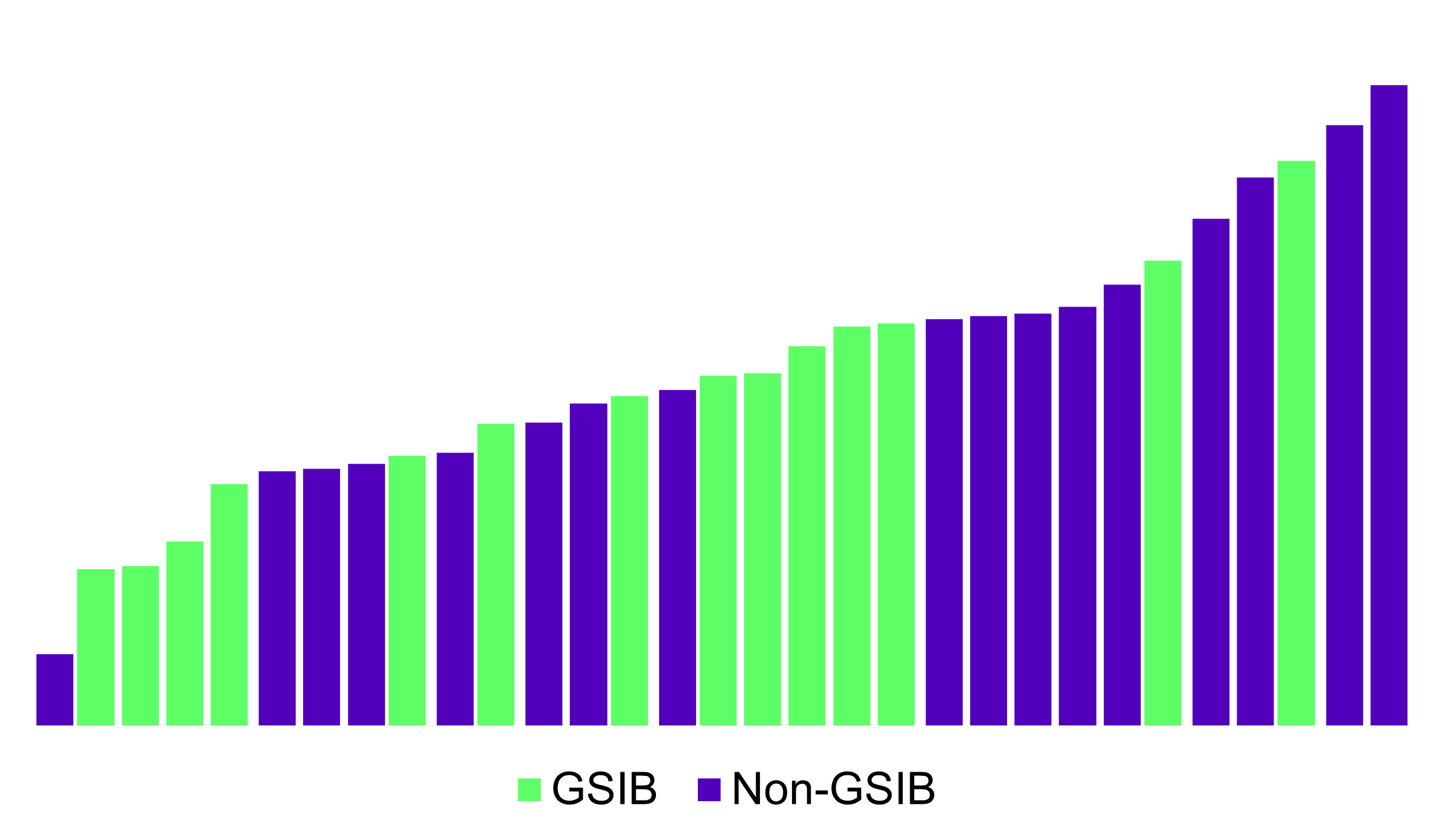

Looking back across 10 years, GSIBs are not systematically the quickest banks to downgrade or upgrade their internal ratings. Figure 1 shows how each bank’s normalized average position during a rating event differs.

Figure 1: Average sequence position comparing GSIBs to non GSIBs

Each bar represents one bank, with those to the left appearing, on average, earlier in sequences of rating changes. These banks can be considered as reacting more quickly to credit events. Rating changes from those on the right side tend to appear later in rating sequences and so these banks could be considered to be, on average, slower to react.

The light green bars show results for GSIBs. The range of results for GSIBs vary greatly. There are many non-GSIBs, including regional banks, which appear to have earlier rating changes. In this article we explore these results in more detail.

Methodology

This section describes how the analysis was put together.

Sequences of downgrades and upgrades are analyzed. Each bank’s position in the sequence is assessed and determines whether that bank leads or lags other banks.

Figure 2 shows an example of a single sequence of downgrades for an example entity and how the rating changes from one bank is incorporated into the analysis.

Figure 2: An example of how the rating sequences are analyzed

The orange line shows the rating path for one bank (Bank A), with arrows showing where they downgraded their internal rating. The blue line shows the path of the Credit Benchmark consensus rating with each blue arrow showing where another bank downgraded their view of the entity.

In this example Bank A moved first in January 2020, ahead of other banks that downgraded later in the year. However, when a second wave of downgrades occurred, Bank A moved slightly behind some other banks.

Across the entire sequence of 12 rating actions across multiple banks, Bank A was 1st and 9th.

The analysis iterates through more than 115,000 entities and calculates sets of sequences of downgrades and upgrades across approximately 40 banks to calculate the ranking positions for every bank. For each bank their average position is calculated (and adjusted for depending on the length of the sequence) to determine their overall score.

The bar charts (like Figure 1) plot the score for each bank, with one bar shows the score for one bank in the Credit Benchmark dataset. The bars are ordered on the x axis by their score, thus showing banks which have an earlier average position in their credit event sequences to the left of the chart.

Analysis of Covid Period (2020 – 2021)

Covid offers a good example of a surprise event.

In January 2020, there wasn’t any anticipation of a global lockdown impacting every country in the world. As the impact of Covid unfolded banks moved their internal ratings at different speeds. Later in 2020 and through 2021 the world started to recover as lockdowns ended and things largely returned to normal.

By rerunning the analysis but restricted to 2020 & 2021 we can compare how banks reacted vs. their behavior across the last 10 years. In addition, we also can also see that there can be a big difference in how quickly banks initially downgraded vs. how confident they were to start upgrading their ratings as economies recovered.

Figure 3: Rankings during Covid years (2020 - 2021)

Figure 3 compares how quickly GSIBs updated their ratings compared to non GSIBs. Compared to Figure 1:

- Some GSIBs who were previously showing as on average slower, moved up in position. There are fewer dark bars at the far right of the graph.

- Some non GSIBs demonstrate that being smaller and regional doesn’t mean that your risk rating systems don’t react as quickly as those of bigger banks.

Figure 4 shows the distribution by Region (based on the home country of the bank). European banks show more clustering in the middle of the pack vs. North America and APAC which show a wider range of speed.

Figure 4: Differences in average sequence position across banks in different regions

The period of 2020 and 2021 was dominated more by downgrades and so taking this further we can compare which banks were quicker to downgrade initially but then slower to improve their credit view as lockdowns and restrictions ended.

Figures 5 and 6 show the positions of GSIBs on downgrade sequences compared to their sequence positions in sequences of upgrades. In general there are more GSIBs to the left for downgrades. This could suggest that larger banks were quicker to downgrade but more hesitant to upgrade again during the recovery.

Figure 5: Average position of GSIBs within sequences of downgrade during Covid years 2020 - 2021

Figure 6: Average position of GSIBs within sequences of upgrade during Covid years 2020 - 2021

At an individual bank level there are clear differences in behavior. Figure 7 compares the same data shown in Figures 5 and 6 but here we show how each bank has moved in the rankings between downgrades and upgrades.

Figure 7: Individual banks position in sequences comparing downgrades vs. upgrades

Each dot represents a bank and its position in the ranking for downgrades on the left and upgrades on the right. The lines link each bank between its downgrade rank and its upgrade rank.

For some banks there is a significant difference between their downgrade and upgrade behavior. For example the bank ranked fourth for downgrades was third-last in upgrade position.

This compares with the bank ranked first for downgrades, which is ranked second for upgrades. This bank consistently updated its internal ratings quickly in response to both the evolving initial lockdowns and to economies reopening.

Why Is It Important to Keep Ahead of Other Lenders?

When a bank downgrades a counterparty due to signs of financial stress, it often triggers predefined risk mitigation protocols. Being the first to take action can materially reduce potential credit losses.

For example, by cutting or freezing credit lines such as revolving credit facilities – these are contingent liabilities that a counterparty may draw on if it faces liquidity issues. If a bank acts first and reduces or cancels unused credit facilities, it lowers its exposure before the counterparty fully draws down available lines. Banks that act later might find counterparties draw down their revolving facilities leading to higher exposure and being forced to honor those drawn facilities.

Downgrading an internal rating could trigger a demand for additional collateral. Acting before other banks to demand more collateral means you’re more likely to receive full margin while the counterparty still has liquidity. If multiple banks request margin simultaneously, the counterparty may become collateral-constrained, leaving later banks under-collateralized. This is especially important in distressed situations, where collateral prioritization becomes critical.

Banks’ internal credit policies could prevent new business once a counterparty falls below a certain rating which means that an early downgrade can prevent further risk accumulation, while slower banks may continue taking on risk.

How Can Credit Benchmark Help Keep Your Banks Credit Ratings up to Date?

As a tool for reviewing your banks performance the type of analysis shown here can help identify if there are areas of your banks rating system that could lag behind other banks.

As well as looking at the speed of rating changes relative to other banks, Credit Benchmark’s analytical tools and data also provide insights into whether your ratings are more conservative or aggressive, how your bank’s rating scale compares to other banks, and whether your bank rank orders its ratings consistently with other banks (homogeneous / heterogeneous rating allocations).

Credit Benchmark data can also be used as an alerting tool to update you every time another bank changes their ratings on entities in your portfolio. Thereby keeping you up to date so you don’t fall behind the curve.